Recently there was an opportunity to speak in front of the Cullen Commission on Money Laundering in Kelowna. Information was shared with the Cullen Commission regarding how the money laundering issues start at the top and how the BC Securities Commission along with provincial government pension fund the former bcIMC now BCI are key contributors to money laundering, fraud and racketeering in BC and worldwide.

See: https://www.kelownacapnews.com/news/kelowna-residents-speak-out-at-money-laundering-commission-meeting/

The press has so far refused to cover how deep the money laundering issue really goes however many members of the press as well as members of the Cullen Commission and various governing officials have all received the following letter which details where to start looking into the issue of money laundering and racketeering in BC.

One of the key issues is the BC Securities Commission and the criminal manner in which it operates.

The latest example of the deception that is modus operandi at the BCSC is how they have scrubbed yet another BC Court of Appeals loss from Court records. The case of Khorchidian v. British Columbia (Securities Commission), 2019 BCCA 411 represents a loss for the BCSC. We do not know the case details however much like CASE #43449 BC COURT OF APPEAL - THE MISSING FILE this case to our knowledge has been scrubbed from court record.

A screenshot seen below will confirm its existence, those who would like a copy of this file may request it via contacting the following address - bk1092003@yahoo.ca

Below is a letter to the Cullen Commission on Money Laundering that outlines major issues with the BC Securities Commission and how it enables racketeering on a mass scale with the involvement of certain members of the BC Government Pension Fund BCI.

Dear Members of The Cullen Commission,Media, and People of CanadaFirst I would like to thank you all for the opportunity I had to speak in front of the Commission, the press and the public in Kelowna last week on the vast subject of money laundering in BC.I applaud you all for undertaking such a vast and important task as the Commission has.It is the sincere hope of many British Columbians and Canadians alike that this Commission will actually have some teeth and the willingness to get to the bottom of the situation at hand. The vast amount of money fraudulently obtained and laundered through BC is simply staggering and mind-boggling.We must be clear that this racketeering does not start nor end with the bags of cash that are being run through casinos, although this is what the public sees it represents but a fraction of the total amount of money that is laundered in BC. This is the low level street money and is simply the tip of the iceberg in terms of how much money is obtained through criminal enterprise whether it be drug money from the streets or the proceeds of crime obtained by pension funds and funneled into the stock markets or offshore accounts. A war on cash will not clean up the crime at the top which is where the real issues are, a war on cash is simply a war on the poor and the people who are victims of a much larger racketeering scheme run by pension funds, banksters, foundations, and regulators.Below I will be providing a myriad of links to information regarding how a massive global criminal cabal has been running a racketeering ring in this province and using BC as a base from which to inflict terror on people around the world. Keep in mind that we know that there are members among you who are involved in covering up such a criminal enterprise as we have outlined below and we know who you are..The first fixes that needs to be made have to start with fixing the BC Securities Commission, the second step is to root out the criminal elements using the BC Govt. Pension Fund, BCI to commit a wide range of crimes including fraud and theft.1. The BCSC is a Self Funded and Self Regulating law enforcement agency that regulates its own investments. This has to change.Due to being Self Funded and Self Regulated the BCSC sits in a constant legal conflict of interest and is not fit to make judgement under the fundamentals of justice and principles of the rule of law. The principles of the rule of law include that law not be arbitrary or whimsical, that it is as free of conflict of interest as possible.Being Self Funded the BCSC literally has to create rules for you to break in order for it to get funded. Of course since it regulates itself even if/when the 'BCSC Commission rules' violate Criminal Code, Securities Law, Supreme Court Law or our Canadian Charter of Rights, the BCSC simply judges itself innocent and continues its sham. What we have found from experience is that if you pay the money for the paperwork the BCSC will look away when it comes to financial fraud.See the work of former high ranking Bay Street Executive Mr. Larry Elford on how our Securities Commissions turn a blind eye to how financial 'advisors' around the nation commit fraud and take peoples money under false pretense for an example of this. As I mentioned in the Kelowna meeting Mr. Elford has spoke in front of Canadian Parliament on these subjects of financial fraud and the money laundering it entails.

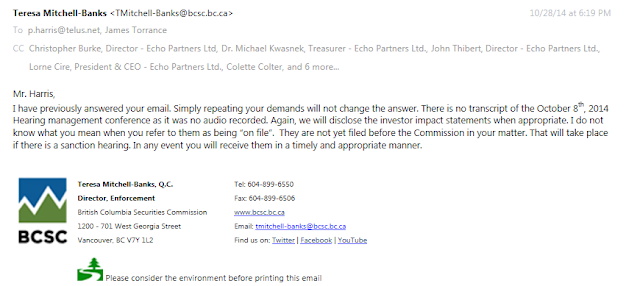

How else does the BCSC abuse its power and the rule of law? How does this lead to fraud and create a money laundering issue?Because the BCSC is self funded and regulates itself its Courts have devolved into 'tribunals' which is usually a dog and pony show in which your rights are trampled and the truth is buried.See how former high level BCSC official Teresa Mitchell-Banks attempts to explain a lack of transcripts to a hearing in which it was questioned about the legality of some of its actions in regard to the Criminal Code.The exert below will demonstrate one of the many ways the BCSC is legally compromised and unfit to make any judgments and rulings, as the province's chief financial regulator this is a serious concern and certainly contributes to the ability of criminals to commit fraud creating money that needs to be laundered.*******************************************In regards to the missing hearing transcript for Oct the 8th and Oct 31st 2014 preliminary hearing. The BCSC insists no such transcript ever existed and it is not standard practice for one to be recorded for a preliminary hearing. At this preliminary hearing there was a stenographer, the director’s all had to state their name for the record at the beginning of the hearing. All other hearings and interviews had transcripts produced including the hearing precluding the Oct 8th hearing. Why would there not be a transcript for this hearing? Even if it is a preliminary hearing? There is a transcript for the March 13/14 2014 preliminary hearing and we will attach it as proof. Why would the next hearing even if 'preliminary' not be recorded?Either the BCSC is lying and withholding the transcript, or the transcript was destroyed.For arguments sake lets pretend the director’s didn't see the Stenographer and nothing was really recorded then this would beg the question how can the BCSC claim to operate as a court with all the authority of Supreme Court as it is so fond of informing us it has. The BCSCs mandate is to operate in a fair, just and impartial manner yet its court proceedings are so far from impartial and just that its a complete joke. Attached is copied a section of the Commissions own policy on hearings. Keep in mind that policy is not law, it must however fall within the confines of the law.<<< Exert from Commission Policy on Hearings>>>PART 2 HEARINGS2.1 Procedures – The Commission conducts hearings less formally than the courts. The Actand Regulation prescribe very few procedures the Commission must follow in hearings.Consequently, except for these, the Commission is the master of its own procedures. In decidingprocedural matters, the Commission considers the rules of natural justice set by the courts andthe public interest in having matters heard fully and decided promptly.<<< End of exert>>>How can the BCSC claim to operate as a court of law yet operate in such an arbitrary manner, by its own admission if it is to follow the rules of natural justice set by the Courts then certainly everything should be on record including a preliminary hearing.

The Commission and its Agents have repeatedly stated that the Commission is not governed by the Canadian Constitution nor is it obliged to operate in a manner that is in accordance with the procedures and rules of Canadian Supreme Court. This is contrary to the Constitution which clearly states that unless specific Provincial Legislation outlines otherwise all laws, regulations, rules, courts, tribunals etc shall operate in accordance with the Constitution Act of 1982 in section 32.

Application of Charter

- 32. (1) This Charter applies

- (a) to the Parliament and government of Canada in respect of all matters within the authority of Parliament including all matters relating to the Yukon Territory and Northwest Territories; and

- (b) to the legislature and government of each province in respect of all matters within the authority of the legislature of each province.

Either the transcript was destroyed or withheld or their never was one in the first place as the BCSC insists. Whichever answer is true it is the position of Mr. Harris and Mr. Burke that the BCSC has lost all credibility as it operates in contravention of either the Canadian Constitution and the guidelines for Supreme Court or the Criminal Code. Neither of these positions would support any supposed authority the BCSC operates with, it has compromised its position and is not fit to regulate the securities market in British Columbia as it does not operate in accordance with the principles of justice and the rule of law.The BCSC is guilty of either withholding/destroying evidence or a breach of the Canadian Constitution either way the BCSC is compromised.According to Ms. Mitchell Banks the following is what happened to the Oct hearing transcripts.

Source - HOW THE BCSC DESTROYED THE LIVES OF FIVE HONEST CITIZENS - 5 REASONS THE BC SECURITIES COMMISSION IS A SHAM*****************************************

Further on how the provinces financial regulator 'regulates' the financial markets. Again to reiterate, with BCSC officials able to commit clear fraudulent and criminal code offenses with near impunity it will be impossible to clean up the proceeds of crime, the laundered money that flows underneath the umbrella of the BCSC.We could go much further on the inequities of the BCSC however it is key that we understand that this simply allows the criminal cabal to operate in the financial circles committing fraud here with near impunity.

2. Investigate and prosecute key staff, board Members and advisors both current and Former of BCI whom have been Involved in a massive criminal operation that includes offshore accounts as indicated in the Panama Papers.The BCSC is connected to one of the biggest contributors of ill gotten gains in North America. The BCSC owns 'securities' in BC government pension fund, BCI which was formerly known as the bcIMC.This pension fund owns hundreds if not thousands of securities across a broad swath of the markets, many of which have assets or operations right here in BC.The bcIMC has been used as a vehicle to commit a wide range of crimes against CanadiansA recent article in the Financial Post revealed that the BC based pension fund BCI, formerly bcIMC has failed to disclose significant Canadian holdings to the SEC.This should not be a surprise to those who have paid any attention to the former BC Investment Management Corporation.With law enforcement in Canada refusing to step in and prosecute the mass amount of financial crime that takes place in both the US and Canada it remains up to the SEC to step in when RICO operations threaten the stability of both nation as is currently the case. We know the Securities Commissions in Canada are a joke and have more akin with a criminal enterprise, will the SEC prove itself different?It has been thoroughly documented by numerous sources on both sides of the border that the BCI (formerly bcIMC) is a criminal enterprise. The money they extort and steal makes its way onto into US stock markets because the holdings of bcIMC are vast and it is highly likely that they are hiding tens of billions offshore due to their offshore connections.

See:

Worksafe Racketeering and Fraud Connected To BCI (Formerly bcIMC)? The Global Racketeering Web and Its Canadian Connections

See:

BCIMC, BCSC, Serco, The BC Attorney General Office, All Connected To RICO Crime?

See:

How the BCI (formerly bcIMC) helped steal a mans $200 million dollar ocean front property.

See:

How the bcIMC defrauded the BC Public with the Timberwest Fraud.

See:

Rich Coleman Pressed Government Pension Fund to Buy TimberWest | The Tyee

See:Then of course there are the connections between bcIMC, Picktons Pig Farm and events surrounding 9/11 and the false flag terror attacks. But of course we know that some of you sitting on this commission have got a little farm 'dirt' on you..Interestingly enough US Firefighters are calling for a full scale investigation into the events of 9/11 due to the fact that it has become blatantly apparent to anyone willing to look at the evidence that the official narrative on 9/11 is a lie. 9/11 was committed as part of a massive fraud operation with connections to BC.

9/11 revisited: New York Fire Commissioners call for new investigation

Tower # 7 was 'pulled' so as to help the same criminal ring that operates through the former bcIMC hide a mass number of financial crimes some of which are rooted here in Canada. There was an FBI field office in that tower pursing this racketeering ring and evidence in that office was vital to this operation.See how below for info on how Barrick Gold (does business in BC, is/was a holding of BCIMC) and arms dealer Adnan Kashoggi are connected to the false flag terror events of 9/11.****************************************The Barrick-Bank Cartel Connection

The relationship between U.S. intelligence and UBS goes back for 60 years. Since WWII, UBS, notably stands out as part of a mix of Swiss banks heavily involved with the U.S. Intelligence community, far removed from Congressional oversight:The interplay of Barrick and the bank and oil cartels crisscross in a manner that strongly suggests ongoing partnership rather than coincidence. There are three pieces of evidence that identify a linkage between the management/ownership of Barrick, the oil cartel, and the German bank cartel. This report finds the individuals involved in planning, executing, and covering the WTC attack to be the same as those involved in Barrick and covert oil operations in Central Asia.

- The Houston office building that housed both Enron and Halliburton corporate headquarters was owned by Trizec Hahn. As earlier discussed, Trizec Hahn was a merger of Peter Munk’s (Barrick Gold) and the Canadian Bronfman family. The CEO’s of both companies, Kenneth Lay and Dick Cheney, are close associates of the Bush family, whose relationship to the founder of Barrick– Adnan Khashoggi – are extensive and stretched over at least two decades.

- Barrick is also directly linked to UBS and the German bank cartel, through use of its subsidiary gold refinery: Argor-Heraeus S.A. Ownership of this refinery was transferred from UBS to Commerzbank, also part of the German bank cartel in 1999.

- Barrick is linked closely to the banking cartel through, one of the most longstanding members of the Advisory Board – Karl Otto Pohl, former President of the German central bank (Bundesbank) and chief officer of the International Bank of Settlements and IMF. Also on the Barrick Board was former Canadian Deutsche Bank executive Tye W. Burt – the former Chairman of Deutsche Bank Canada and Deutsche Bank Alex Brown Securities Canada, and Managing Director and Head of Deutsche Bank’s Global Metals and Mining Group. Burt was involved when the Canadian Deutsche Bank backed Khashoggi in the MJK Securities fraud. Burt left the bank shortly after the fraud was discovered. Note also, two of the initial big investors in Barrick – Khashoggi and Bronfman – used the same personal financial advisor: Mayo Shattuck of the Deutsche Bank Alex Brown. Mayo Shattuck was the chief assistant to Buzzy Krongard when he worked at Deutsche Bank Alex Brown. Both, through their executive roles at Deutsche Bank Alex Brown were in a position to be familiar with the Khashoggi/Marcos gold deposits at that Bank. Remember that Krongard managed the merger between Bankers Trust and Deutsche Bank Alex Brown, and that Banker’s Trust is the bank that received significant amounts of the Marcos gold with the assistance of Khashoggi.

Stocks

Updated world stock indexes. Get an overview of major world indexes, current values and stock market data.

- The Deutsche Bank was identified as a major gold trading partner with Barrick in both the Blanchard and Howe law suits.

- Enron – an energy trading company – had created a gold bullion and gold derivatives trading operation. When Enron went bankrupt, Enron Online was bought by UBS. A competitive market for trading energy and gold bullion was set-up by former Deutsche Bank executive Mayo Shattuck as new CEO at Constellation Energy, using former Enron employees.

These five points suggest that if it doesn’t exist already, there exists the potential for a cozy relationship between the U.S. oil cartel, the German banking cartel and Barrick.Link between the WTC, Illegal Gold, and Money Laundering

The key matter for consideration and inquiry is that, according to John O’Neal, and Sibel Edmonds, the FBI (whose files were in the WTC North Tower) was denied information by the CIA and Secret Service. The CIA’s files would have been kept in Building Seven. One has to presume that any files relating to financial investigations of money laundering related to “intelligence” operations and the Russian/Israeli mafia around Azerbaijan, Kazakhstan and Afghanistan were kept in Building Seven or Tower 1.The WTC offices also held investigative information for the Bank of New money laundering scandal, which will later be shown to be intricately linked to covert oil operations in the aforementioned countries. From another perspective, three of the agencies involved in the Enron investigation were housed in the WTC: SEC, the Justice Department, and the FBI. With a great deal of certainty this report concludes that Enron was a major money-laundering vehicle for the financial rape of Russia, buying and selling petrochemical contracts from the U.S. subsidiaries of the Russian oligarchs. Both DoD and HUD had contracts with Enron, and those agencies were reported by Rumsfeld (on September 10, 2001) to be unable to account for some $3.3 trillion in funding. The IRS, in Building 7, was looking at Barrick’s offshore hedge book.“The contention that the destruction of the WTC was used to destroy evidence contained on the 23rd and 24th floors of the North Tower is now incontrovertible. …Here is evidence supplied by the Head of Security of the World Trade Center on network television indicating that the floors used by the FBI (22nd, 23rd and 24th floors) of the North Tower — 70 floors below the crash-bombing impact — had been devastated and reduced to debris. This same Head of Security himself dug through the debris to save persons who were trapped there. It was on these floors that the evidence and investigation briefs on two highly important cases were being stored: 1) The case against Mobil Oil and James Giffen on illegal oil swaps between Iran and Kazakhstan (at that time before a New York grand jury as described in great detail by Seymour Hersh in the July 9 New Yorker magazine); 2) The evidence in the investigation of Gold Price Fixing which stemmed from charges brought against Alan Greenspan, Morgan & Company and Goldman Sachs. At noon E.P. Heidner received a phone call from New England from friend who was reviewing recorded footage of coverage of the destruction of the WTC on NBC’s program “48 Hours.” Steve has reviewed the footage many times and taken detailed notes. I took notes at my computer as he spoke. After the south tower collapsed, men went up to the 22nd floor of the WTC and “dug” someone out of the “rubble” he found there. It is known that these floors contained the New York FBI offices. Peter Jennings actually did a two-day network news story on the effects of the destroyed evidence and files on American financial crime investigations around the world. The 48 Hours anchor was interviewing the Head of Security of the WTC about the evacuation. He had received a call, after the South Tower was down, from the Port Authority’s Command Center on the 22nd floor asking for rescue. The Head of Security himself traveled to that floor in the company of a NY Fireman where they found the offices devastated to the point that they had to “tunnel through debris” to “dig out” the two or three Port Authority workers who were trapped there. All of this happened 73 floors below crashbombing impact.” [WTC Attack Destroyed Criminal Evidence , Dick Eastman, http://www.conspiracyplanet.com, 10/26/2001]Eastman’s report is substantiated by other reports from CBS News and an individual chronicler of events. These reports suggest that while one drama unfolded throughout the WTC complex, another drama was unfolding on the 22nd Floor of the North Tower.The result of the loss of this building was a major loss of investigative documentation by U.S. agencies. Agencies known to have lost evidence include the Export-Import Bank (source of loans to Afghanistan and Angola), CIA, SEC, IRS and Secret Service.Investigative and Evidentiary Agencies in the WTC Building 7

Export-Import Bank of the US – Floor 6U.S. Secret Service – Floors 9 & 10Securities and Exchange Commission – Floors 11,12 &13Internal Revenue Service – Floors 24 & 25CIA – Floor 25Department of Defense – Floor 25In the key emergency control center of New York in Building 7 (free-fall building), someone gave the order to evacuate the building and the control center. No one knows who gave that order. In the buildings that were supposedly hit by planes, personnel were not given that order, and remained in the control centers until the end. Investigators of financial crimes throughout the U.S. lost evidence in thousands of cases, including original SEC filings falsely reporting the Deutsche Bank’s lack of involvement in the Cayman shell companies of Enron.Talk about destroying evidence. Clinton’s missing emails is nothing compared to the destruction of evidence in the WTC and Pentagon.The Unmentioned Loss of WTC 6

A key hypothesis of this report is that the attack on the World Trade Center was intended to stop investigations into various forms of money laundering by officials of the U.S. and the Russian/Israeli Mafia. It would not be appropriate to discuss Building 6, which housed U.S. Customs – one of the key U.S. Agencies with responsibility for investigating money laundering. The fate of Building 6 is ignored in virtually every report available, but the couple of references found are totally aligned with the hypothesis that these agencies were targeted.Gold Trading and Money Laundering Investigations Cancelled by Destruction of the WTC

The 23rd floor of the North Tower of the WTC held FBI records pertinent to investigations of international gold movements and violations of the U.S. Foreign Corrupt Practices Act. The stimulus for the FBI investigation was a lawsuit initiated by GATA against a number a major bullion international banks and the former US Secretary of the Treasury. The lawsuit alleged that these banks conspired to manipulate and artificially depress the price of gold. The evidence presented by GATA was quite compelling, and suggested that 1) these parties had used national gold reserves to illegally regulate the price of gold, 2) these banks had created a significant risk that threatened the liquidity of all of the key players, and 3) that the national gold reserves had been illegally depleted as a result.KEY POINT: The basis for this suit was analysis of gold market prices and trades that suggested approximately 14,000 tons of paper gold had been artificially created to keep gold prices depressed. This report speculates that gold prices were not being manipulated, but rather 14,000 tons of stolen gold was being illegally laundered.The logic of what GATA called a scam “on the American citizens and individual gold buyers” was this. Bullion banks “loan” gold to each other at 1% or 2% interest. When they borrow gold to cover needs, they buy a gold future and assign it the lender. Thus the lender always has the “same” amount of gold, except some is ‘paper gold.’ According to GATA, these banks would loan gold to each other, and then sell the real gold, using the proceeds to invest in equities, which paid a higher return. This is a good deal when the investment’s return on the equity is greater than the costs of the increased price of gold. The GATA claim is that this process had been going on secretly for a number of years, with U.S. private banks making hefty profits using U.S. treasury gold. This process is not illegal – fixing-prices is.At some point in the process, these banks had loaned out more gold than could be produced by all the gold mines in the world in the next two and a half years. Because the world started viewing the dollar as overvalued, there was a move towards gold, which stood to drive the price of gold up – dangerously so. These banks then had to borrow and sell even more U.S. gold, and then (it is contended) brought in the London banks to support them, to keep the price of gold artificially down. The prices had to be kept artificially low because if there was an actual call on the gold loans by one bank, it would bring them all down like a house of cards. There was not enough physical gold available to make good all the futures being held by the banks.It has been speculated that it was these banks – with a focus on the American banks -that somehow brought about an attack on the FBI office, using the cover of the airliner assault to destroy the evidence against them. According to this theory, the attack needed to happen before October 9, 2001, when this lawsuit opened in court. It may be fair to speculate that U.S. bank executives were not worried about being convicted for violation of dubious and ambiguous laws. However – win or lose, this report speculates there was at least one group of bank executives that had plenty of reason to worry if this lawsuit saw the open courtroom, and that is the group that set out to destroy the World Trade Center. These are the executives who were worried that an investigation and trial would expose their gold laundering activity.KEY POINT: This report speculates that gold being sold on the market was not ‘artificially created,’ but rather illegal, stolen gold that needed to be laundered.Source - TREASON: Who Did 9/11 And Why Did They Do It? – The Millennium Report*****************************Private US based intelligence syndicate Abel Danger has outlined a large portion of these crimes and their links to BC Pension fund BCI/bcIMC. Abel Danger is made up of both retired and embedded and active intelligence, law enforcement, and military operatives as well as thousands of other individuals in a wide manner of industry segments from across the globe. We can provide contact info upon request.See:#1603: MARINE LINKS CON AIR MARCY PIG-FARM RAVES TO BCIMC PEARCE, CAI PENSION AND STARNET RAID

Plum City – (AbelDanger.net). United States Marine Field McConnell has linkedhis sister Kristine ‘Con Air’ Marcy’s apparent use of the U.S. Justice Prisoner and Alien Transportation System to book parolees and their guards into raves at the Pickton Family pig farm in British Columbia, to an alleged conspiracy between bcIMC’s Doug Pearce and his CAI Private Equity/RCMP pension-fund managers to raid Starnet’s Carrall Street, Vancouver, command center in 1999 and transfer the company’s online-betting, interactive porn and up-down body-count assets to Marcy’s U.S. Senior Executive Service in WTC Building #7 in New York.McConnell claims that Marcy, bcIMC Pearce and CAI pension-fund special investor, the late General Alexander Haig, used Nortel’s Joint Automated Booking System and Macdonald Dettwiler & Associates war rooms to develop Starnet’s up-down body-count betting floor, allegedly tested at pig farm raves (1996-2001) in preparation for the 9/11 Global Guardian war games.McConnell is celebrating Abel Danger’s expose of his Con Air sister’s role – see bio – in the 1999 raid on Starnet and the transfer of its betting systems to WTC#7 before 9/11, with a Victory Party on 18-21 July in Plum City, Wisconsin, with key event being a Celebration Dinner at Vino in the Valley with transportation arranged by Plum City Limos PLLC, a transportation ally of Abel Danger Global Private Intelligence Agency.

Vino in the Valley-Travel Pierce County-Vacation Western WisconsinPrequel 1:

#1602: Marine Links FDNY Up-Down Body-Count Betting to SES Sister Marcy in Starnet Building #7bcIMC's Doug Pearce and 'the Farm'.Marine Links Nortel CAI JABS to Doug Pearce Shorts in B.C. Pig-Farm Pension Plan

Are Former RCMP Commissioner Paulson, Former bcIMC staff members Kristine Marcy and Doug Pearce and the bcIMC (BCI) itself linked to 9/11, child porn and fraud?

Media Coverage of Starnet Raid - August 20, 1999 [Kristine Marcy’s SES agents in IRS/Customs allegedly conspired with former RCMP sergeant Bob Paulson to confiscate Starnet assets and move them into custody of SES in WTC#7 to support up-down body count bets on 9/11]

CAI Investor Alexander Haig · 9/11 Starnet Snuff Porn & Gambling

CAI Investor Alexander Haig · 9/11 Starnet Snuff Porn & Gambling

See:“7 World Trade Center is a building in New York City located across from the World Trade Center site in Lower Manhattan, and is part of the World Trade Center complex. It is the second building to bear that name and address in that location. The original structure was completed in 1987 and fell after the Twin Towers collapsed in the September 11 attacks. The current 7 World Trade Center opened in 2006 on part of the site of the old 7 World Trade Center. Both buildings were developed by Larry Silverstein, who holds a ground lease for the site from the Port Authority of New York and New Jersey.The original 7 World Trade Center was 47 stories tall, clad in red exterior masonry, and occupied a trapezoidal footprint. An elevated walkway connected the building to the World Trade Center plaza. The building was situated above a Consolidated Edison (Con Ed) power substation, which imposed unique structural design constraints. When the building opened in 1987, Silverstein had difficulties attracting tenants. In 1988, Salomon Brothers [apparent founder investors with the late General Alexander Haig of the CAI Private Equity Group which allegedly sponsored the development of the Starnet command center in Vancouver in support of up-down body-count betting, interactive S&M snuff-film production and sexual entrapment and extortion at the Pickton Family pig-farm in Port Coquitlam from 1996-2001] signed a long-term lease, and became the main tenants of the building. On September 11, 2001, 7 WTC was damaged by debris when the nearby North Tower of the World Trade Center collapsed. The debris also ignited fires, which continued to burn throughout the afternoon on lower floors of the building. The building's internal fire suppression system lacked water pressure to fight the fires, and the building collapsed completely at 5:21:10 pm.[2] The collapse began when a critical internal column buckled [allegedly after Marcy’s SES agents authorized the remote ignition of incendiary bombs placed by Amec personnel operating out of Amec’s Carrall Street, Vancouver offices, adjacent to the Starnet betting command center raided by Marcy’s SES in 1999] and triggered structural failure throughout, which was first visible from the exterior with the crumbling of a rooftop penthouse structure at 5:20:33 pm.…….Seven World Trade Center, building 7 of the World Trade Center in New York City, was completed in 1987 at a height of 185 m (610 ft).According to The New York Times and CBS News, one of the federal agencies listed below was incorrect, as it was actually used as a front for CIA operations.[1]

List of Tenants in WTC Building #7

Source -

The connections the bcIMC has to various criminal enterprise could likely fill data chips and hard drives. From the drug companies under its umbrella who flood our streets with product or in its reach to the neferious activities of Barrick Gold and SNC Lavalin, the bcIMC (BCI) and key members have been operating a massive racket that is destroying not only the province but nations around the world***************************This is but a fraction of the evidence regarding the BC Securities Commission, BCI and a massive racketeering operation here in BC. It is important to note that the proposed new national securities regulator will not help to fix these issues it will actually make issues worse with its new proposals to prop up dead horse markets in order to ensure 'no material effects' harm the markets. Read about how regulators could have the power to jail whistleblowers for telling the truth about a companies business if it affects the price of the company. The proposed new regulators want the power to enable fraud indefinitely,

See:

NEW CANADIAN REGULATORS REMOVE 'INTEGRITY' FROM FRAMEWORK - REPLACE IT WITH 'MATERIAL ADVERSE EFFECTS'

This is contrary to the fundamentals of justice and the rule of law. Regulators like the BCSC have no remedy under the law for their criminal actions.

See:

BC SECURITIES COMMISSION HAS NO REMEDY UNDER THE SECURITIES ACT FOR CRIMINAL BEHAVIOR

The top financial regulators in the province operate more like a criminal operation then a law enforcement or judiciary body, this enables a massive amount of fraud and racketeering to take place creating a large sum of money that needs to be laundered. This money is not just cash going into casinos or real estate, it is being funneled into stock markets, pension funds, private foundations, and offshore accounts. It is the lives and assets of the people of Canada being stolen under our noses with the aid of those who are tasked with protecting the public. It is time for this to end.

No comments:

Post a Comment